In the ever-evolving landscape of digital payments, the collaboration between reality TV star turned digital influencer Prince Narula and PayPal marks a significant milestone.

This partnership not only taps into Narula’s massive follower base but also aims to reshape how young Indians perceive and engage with digital financial services. Through strategic endorsements and innovative campaigns, they are setting new standards for convenience, security, and trust in digital transactions.

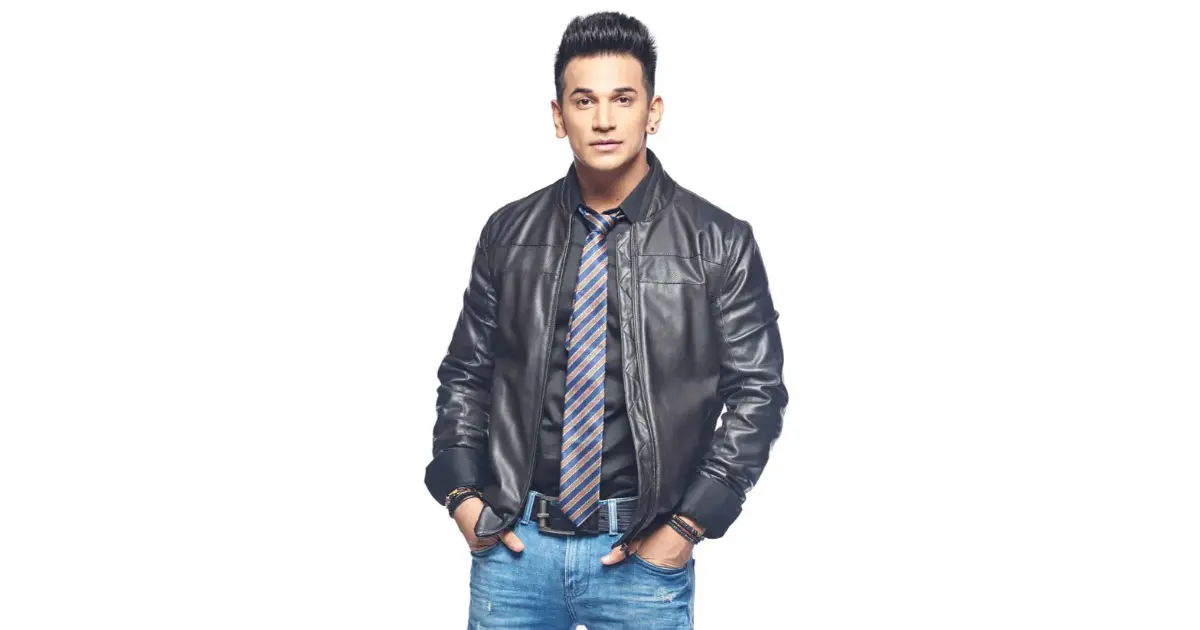

The Rise of Prince Narula: From TV Star to Digital Influencer

Prince Narula, a household name in India, initially captured public attention through his wins in various reality shows. Since then, he has successfully transitioned into a digital influencer, leveraging his fame to impact a wider, digitally-savvy audience through social media platforms.

Table: Prince Narula’s Influence Across Different Platforms

| Platform | Followers | Engagement Rate | Average Likes per Post |

| 4 million | 3.5% | 120,000 | |

| 500,000 | 1.2% | 1,500 | |

| YouTube | 1 million | 4% | 200,000 |

The Growing Importance of Digital Payments in India

Digital payments are rapidly becoming the backbone of India’s financial system, with increased internet penetration and mobile device usage boosting their popularity. These convenient payment methods are essential for the modern economy, fostering financial inclusion by reaching unbanked and underbanked populations.

Chatgot: The Ultimate AI Solution

How Prince Narula Promotes Digital Payments with PayPal

Prince Narula uses his extensive online influence to promote the benefits of using PayPal, focusing on its convenience and security features. His promotional strategies typically involve social media posts, interactive sessions, and collaborations with PayPal to reach a broad audience effectively.

Key Features of PayPal and How They Benefit Users

PayPal simplifies online transactions with features designed for security and ease of use, including One Touch™, Buyer Protection, and Fraud Protection. These features ensure that both newcomers and seasoned users can transact with confidence.

Table: Key Features of PayPal and User Benefits

| Feature | User Benefit |

| One Touch™ | Fast and secure checkout |

| Buyer Protection | Refunds on misdescribed items |

| Fraud Protection | Real-time monitoring of transactions |

Empowering Small Businesses Through PayPal

Small businesses benefit immensely from PayPal’s tools and services, which facilitate easy setup and low-cost transactions. PayPal also helps these businesses reach a global market by simplifying cross-border payments.

Key Benefits of PayPal for Small Businesses

Using PayPal, small businesses enjoy features like immediate transaction processing and access to a user-friendly mobile app, which are crucial for business agility and growth. Additionally, PayPal’s reputation as a secure payment gateway helps in building customer trust.

Table: Benefits of PayPal for Small Businesses

| Benefit | Description |

| Low Transaction Fees | Minimized costs for processing payments |

| Quick Setup | Easy account setup and integration on websites |

| Global Access | Accept payments in multiple currencies |

Prince Narula Digital PayPal: Targeting Millennials and Gen Z

Targeting the tech-forward and financially conscious Millennials and Gen Z, Prince Narula’s partnership with PayPal focuses on aligning with their preferences for quick, efficient, and secure digital solutions in their financial transactions.

Table: Features of PayPal That Appeal to Millennials and Gen Z

| Feature | Appeal |

| Social Media Integration | Seamless sharing and payment via social platforms |

| Rewards and Incentives | Attractive offers for frequent users |

The Future of Digital Payments: Prince Narula Digital PayPal Leading the Way

As digital payments evolve, partnerships like Prince Narula Digital PayPal are poised to play a pivotal role. By integrating advanced technologies and marketing strategies, they aim to further popularize digital payments among the younger demographics.

Table: Trends Shaping the Future of Digital Payments

| Trend | Impact on Digital Payments |

| Increased Mobile Use | Higher transaction volume via mobile devices |

| Blockchain Technology | Enhanced security and transparency |

Conclusion

Prince Narula’s journey from a TV star to a key promoter of digital payments illustrates the merging paths of entertainment and financial technology. This partnership with PayPal not only benefits users by providing secure, simplified financial transactions but also sets the stage for the future of digital payments in India.

Frequently Asked Questions

How does Prince Narula’s endorsement help PayPal users?

His widespread appeal helps familiarize his large follower base with PayPal, increasing their comfort level with using the service.

Can PayPal be used for cross-border transactions?

Yes, PayPal supports international payments and currency conversions, facilitating global transactions.

What security features does PayPal offer?

PayPal offers comprehensive security measures including end-to-end encryption and continuous fraud monitoring to protect user transactions.

How does PayPal benefit small businesses?

It provides them with a reliable, low-cost platform for processing payments and accessing new markets.

What role does PayPal’s Buyer Protection play?

This feature ensures that buyers receive their money back in case of fraud, significantly reducing transaction risks.